Let’s talk about money.

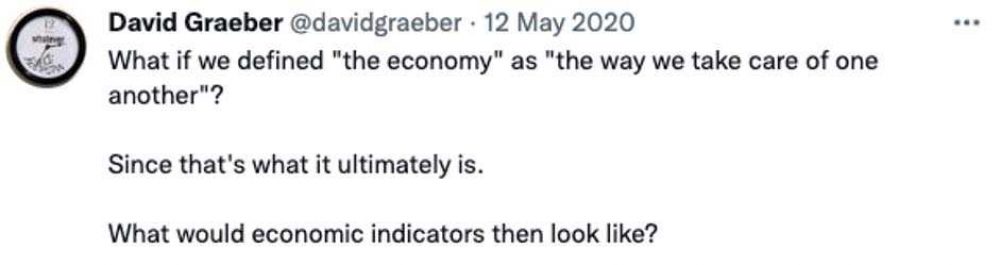

For the longest time, if I heard the word “money” it gave me the ick. I just didn’t get it, and I didn't really want to get it, so it took a while for me to get my head around how money is a means to an end. This is especially true when you consider this idea:

What does this tweet mean in translation? It means treating money management as a form of self-care, and community care.

I'm like that - I hate thinking about money and I don't know how to start!

So, how can you feel less anxious about managing your money, so you can look after yourself and your community better?

Are you tracking your finances? You’re more likely to be anxious about what you don’t know than what you do. It helps to check your bank account regularly and to think of doing budgets as a form of self-care

Remember that it’s never too “late” to start saving. Start with small goals, and work towards something bigger. That way when you do hit your saving goals, you know that they’re achievable! How about setting up an automatic transfer to move £5/£10 every month into a savings account?

- Look out for your future, get your pension sorted! When money is tight, and if you’re on short-term/zero hour contracts, you can’t help but think that you’re ‘here for a good time, not a long time.’ But, it’s important to look out for future you - especially if you’re a freelancer. If you start your pension sooner, your money will have more time to grow and it will stretch further. According to MSE, the ideal percentage of your earnings you should be putting away is half the age you start contributing towards your pension. If you can’t afford that percentage, reduce it to suit you right now. Remember that your employer will contribute towards that percentage, and you need to make up the shortfall if you can afford to. For example,

Jo started their pension at the age of 20. Jo puts away 10% of their earnings towards their pension every year until they retire

Jo’s monthly pay is what’s left after their employer deducts national insurance contributions, tax, and the 5% pension contribution

That means Jo uses their own money to pay the remaining 5% left of the 10%

How do I get better at ‘saving’?

1 in 10 Brits (9%) have no savings at all, so don’t beat yourself up if you aren’t able to put money away. Young people in particular have been hit hardest when it comes to jobs during the pandemic. Not everyone can afford to save, especially when we live in a society of growing inequality, and the 'minimum wage' isn’t a true living wage.

Everyone has different situations which means that you need to think about what works for you. Here are some examples of what works for different people:

- some people get really good at using spreadsheets for budgets! Here’s where you can start

this template by Valentina Vela could be helpful

subscribe to the Girls Night In Newsletter, they have loads of good free spreadsheets to download - these include budgeting, meditation and home work out resources

some shop around for your bank accounts. Your bank should work for you! Some bank accounts now provide a breakdown of where your money is going, and some do “round up” savings where you round up to the pound what you’re spending and the pennies are put towards a savings pot

some people use apps which can help with gameify saving, like IFTTT. I’ve synced up my apps to it, so say if I reach my daily steps goal - I get money moved to my “Treat yo’self” Monzo pot. You can also make your own rules too (like every time you tweet, money gets sent to a different pot)

other people look at cash back websites to help make their money stretch further.

you can also look at price comparison websites and don’t be afraid to ring up to get a better deal, this is especially true when it comes to your mobile deals and shopping for insurance!

I want conversational resources that will help me manage my emotions better when it comes to money:

the FW Forum has guidance on how to have a compassionate approach to managing your money. Check out this article on how to live with a budget

Mind’s resources give practical tips on managing money and your mental health, this is especially if you’re an emotional spender. A lot of people tend to spend more when they’re in a low mood - me included!

In Good Company podcast. Episodes are mostly an hour and they cover the emotional aspect of money, and how it relates to your identity too

Pennies to Pound podcast. Episodes are at most 30 minutes and they cover a range of topics like going on an apprenticeships vs. Uni, ISAs, and your side hustle too

sign up to Money Saving Expert’s newsletter! It’s weekly and Martin Lewis gives you an accessible way of understanding what on earth is going on with the world of business and how that affects our money

here’s our resource on what it means to be self-employed and advice on financial wellbeing when you’re your own boss

I’m facing financial difficulties and I don’t know what to do:

if you are unsure about how much you claim in benefits, check out the Turn2Us Benefits Calculator

if you’re worried about being able to pay your energy bills, check out Citizen Advice’s webpage on next steps

if you’d like a local guide to help with benefits, money, housing problems and more, check out AdviceLocal

if you’re in debt and feel like you’re worried about bailiffs or things closing in, please get in touch with Step Change. They’re a debt charity who can help, especially with setting you up with a debt management plan for free

National Debtline is a charity that gives free and independent debt advice over the phone and online. They have a really helpful resource in creating your factsheet (where you list your situation and your current money situation), this will help you with getting tailored advice. Plus, they have a library of sample letters to write to agencies when managing your debt

if you feel like you’ve had terrible customer service from agencies, Money Helper has easy-to-use letter templates if you need help to complain about this too

This isn’t an exhaustive list at all. It’s here because it’s challenging to think and work towards the dream version of ourselves if we are worried about “not having enough” - whatever “enough” means. It’s even trickier when we acknowledge that pay in the arts is low when you’re starting out.

While it may take a while to get to your “dream” salary and lifestyle, it doesn’t mean that you can’t start building your knowledge and habits so that you have a healthier relationship with money.